We are all aware of the many 2020 hardships. Coronavirus, unemployment, business closures, etc. have taken both emotional and financial tolls. But why add to these hardships by ignoring tax obligations? Now is the time to pay attention to 2020 tax planning and 2020 tax filings. In addition, now may be the time to pay attention to those prior year returns that were previously neglected. As a business owner, one of the last things you need during this tumultuous period is a tax lien placed against your business or personal property.

Dealing with federal and state tax authorities can be very daunting. Recently the IRS has made it a bit easier to set up payment agreements; offers in compromise and other relief measures to help taxpayers struggling with tax debts. However, dealing with California tax authorities can be a different story.

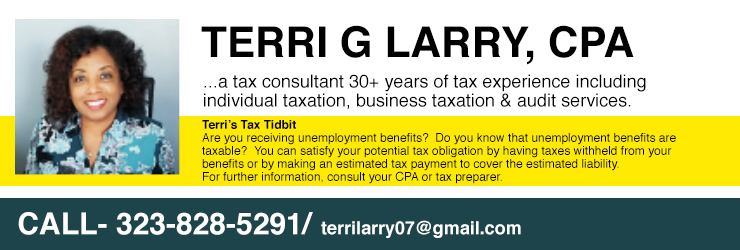

Please contact your personal tax advisor to determine your current tax or tax defense opportunities. If you are in need of a tax advisor, please contact Terri Larry at 323-828-5291.

Terri G Larry, CPA has been a corporate/small business/individual tax consultant for over 30 years. Terri was raised in Compton, CA , attended St. Michael’s High School in South Los Angeles and graduated from California State University at Long Beach. Terri has been employed at various Fortune 500 Corporations during her tax career including DIRECTV where she was the Senior Manager of audit and planning. Terri is now working to share everything she has learned to help small business achieve tax and financial goals.

Terri can be reached at terrilarry07@gmail.com or 323-828-5291. In order to get an idea of your business needs, Terri offers an initial one-hour consultation free of charge.

Recent Comments